An Unbiased View of Pvm Accounting

An Unbiased View of Pvm Accounting

Blog Article

Fascination About Pvm Accounting

Table of Contents8 Easy Facts About Pvm Accounting DescribedPvm Accounting - The FactsNot known Factual Statements About Pvm Accounting Get This Report about Pvm AccountingPvm Accounting - TruthsThe smart Trick of Pvm Accounting That Nobody is Talking About

Supervise and deal with the production and authorization of all project-related invoicings to clients to foster good communication and stay clear of concerns. Clean-up accounting. Ensure that suitable records and paperwork are submitted to and are updated with the IRS. Make sure that the accountancy process adheres to the legislation. Apply called for building and construction accountancy requirements and treatments to the recording and reporting of building and construction task.Understand and maintain standard cost codes in the audit system. Communicate with various funding companies (i.e. Title Business, Escrow Firm) pertaining to the pay application process and needs required for payment. Take care of lien waiver disbursement and collection - https://www.wattpad.com/user/pvmaccount1ng. Screen and fix bank problems including charge anomalies and examine differences. Help with implementing and keeping interior monetary controls and treatments.

The above declarations are intended to define the general nature and degree of job being carried out by individuals designated to this category. They are not to be taken as an exhaustive listing of responsibilities, obligations, and skills called for. Workers might be called for to perform responsibilities beyond their regular obligations from time to time, as needed.

Pvm Accounting Fundamentals Explained

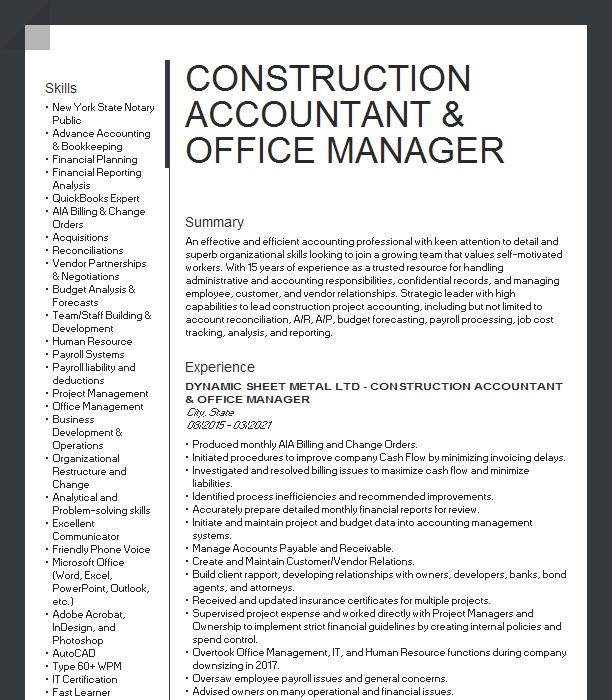

You will certainly aid sustain the Accel team to guarantee distribution of successful on time, on budget, jobs. Accel is looking for a Building and construction Accounting professional for the Chicago Office. The Building and construction Accounting professional does a selection of accountancy, insurance coverage compliance, and task administration. Functions both independently and within particular divisions to preserve monetary records and make sure that all records are maintained present.

Principal duties consist of, yet are not restricted to, managing all accounting functions of the company in a timely and exact manner and providing reports and schedules to the company's certified public accountant Company in the prep work of all financial statements. Ensures that all accounting procedures and functions are handled accurately. Accountable for all financial records, payroll, financial and daily procedure of the bookkeeping feature.

Prepares bi-weekly trial balance records. Works with Project Supervisors to prepare and upload all month-to-month billings. Procedures and issues all accounts payable and subcontractor payments. Generates month-to-month recaps for Workers Settlement and General Responsibility insurance premiums. Generates regular monthly Job Cost to Date reports and collaborating with PMs to integrate with Job Supervisors' budgets for each task.

3 Easy Facts About Pvm Accounting Explained

Effectiveness in Sage 300 Building and Genuine Estate (formerly Sage Timberline Office) and Procore construction administration software program a plus. https://www.edocr.com/v/0bwa8kov/leonelcenteno/pvm-accounting. Should likewise be efficient in various other computer software program systems for the prep work of records, spreadsheets and other accounting evaluation that may be needed by monitoring. construction accounting. Must possess solid organizational skills and capacity to focus on

They are the economic custodians that make sure that building and construction projects continue to be on spending plan, adhere to tax policies, and keep financial openness. Building accountants are not simply number crunchers; they are critical companions in the building and construction process. Their primary function is to handle the financial aspects of building and construction jobs, making certain that resources are allocated effectively and monetary risks are lessened.

See This Report on Pvm Accounting

By keeping a tight hold on project financial resources, accounting professionals assist protect against overspending and financial troubles. Budgeting is a keystone of effective building and construction projects, and construction accounting professionals are important in this respect.

Navigating the complicated web of tax obligation regulations in the building and construction industry can be challenging. Building and construction accountants are well-versed in these regulations and make sure that the task conforms with all tax obligation demands. This includes handling pay-roll taxes, sales tax obligations, and any various other tax responsibilities specific to construction. To master the function of a building and construction accounting professional, individuals need a strong educational structure in accountancy and financing.

Additionally, qualifications such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Market Financial Expert (CCIFP) are very concerned in the industry. Working as an accountant in the building industry features a special collection of difficulties. Building and construction projects usually include limited deadlines, altering regulations, and unexpected costs. Accounting professionals should adapt promptly to these challenges to keep the task's financial health and wellness undamaged.

The Definitive Guide for Pvm Accounting

Ans: Construction accounting professionals produce and keep an eye on budget plans, recognizing cost-saving possibilities and ensuring that the job remains within budget plan. Ans: Yes, building and construction accounting professionals manage tax obligation compliance for construction tasks.

Intro to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction companies have to make difficult selections among numerous economic choices, like bidding on one task over one more, picking financing for products or equipment, or setting a project's earnings margin. On top of that, construction read the article is a notoriously volatile market with a high failure rate, sluggish time to payment, and irregular capital.

Typical manufacturerConstruction service Process-based. Production involves repeated processes with quickly recognizable costs. Project-based. Manufacturing needs various processes, materials, and tools with differing costs. Dealt with place. Manufacturing or manufacturing occurs in a solitary (or a number of) regulated locations. Decentralized. Each task occurs in a new area with differing site conditions and special challenges.

8 Simple Techniques For Pvm Accounting

Frequent use of various specialty contractors and vendors influences effectiveness and money flow. Payment arrives in complete or with normal repayments for the full contract amount. Some part of payment may be withheld till task conclusion also when the specialist's job is completed.

Regular manufacturing and temporary agreements result in manageable cash flow cycles. Irregular. Retainage, sluggish payments, and high in advance expenses bring about long, irregular cash money circulation cycles - financial reports. While conventional producers have the advantage of controlled atmospheres and enhanced manufacturing procedures, building firms have to frequently adjust to each brand-new project. Even somewhat repeatable tasks need alterations because of website conditions and various other elements.

Report this page